On its face, the process for filing an insurance claim for injuries you suffer in a Maryland auto accident is simple: Fill out the proper forms, send them to the insurance company, and wait for the check. In practice, the actual process is anything but straightforward. Insurance companies deny claims for one reason and it is business-related. They do not want to compensate you for your losses because that cuts into their profits.

However, adjusters will cite many other justifications for rejecting a claim or making a low-ball offer that does not adequately cover your medical expenses, lost wages, and pain and suffering. A few of the more common reasons to deny your claim include:

You Did Not File Your Claim on Time

Insurance companies have time constraints on how long you have to file your claim after a crash. If you do not report the incident within the relevant period, an adjuster may assert that there was not enough time to research the circumstances surrounding the accident. Regardless of the insurer’s deadlines, Maryland also has a statute of limitations in car accident cases. If you do not sue the responsible driver within three years after the incident, you are forever barred from filing a lawsuit.

You Failed to Provide Proof that the Other Driver was at Fault

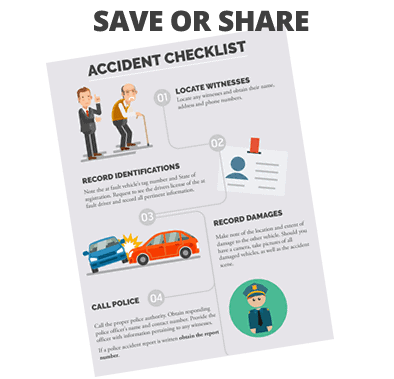

Many auto collisions are a “he said/she said” situation in which each driver alleges the other was responsible for causing the crash. You can be sure that the insurance company will contest your version of events if it gives them an excuse to not pay your claim. Your best bet is to thoroughly document all details of the car accident by taking photos, writing down your own personal account, talking to witnesses, and noting such conditions as weather, traffic, construction, or other factors. Your chances of succeeding on your claim improve if you provide this proof in your claim.

You did Not Seek Immediate Medical Attention

The longer you wait to visit a doctor, the more likely it is that an adjuster will see your injuries as minor. A trip to the emergency room, urgent care center, or your own primary care physician serves as support for your claim that you were hurt badly. Plus, an insurance company may even contest whether your injuries were due to the car accident or some other incident that occurred afterwards.

Your Claim Exceeds the Responsible Driver’s Coverage

Maryland has certain minimum auto insurance requirements, and motorists must carry at least $30,000 in coverage for bodily injury claims; some drivers may choose to increase this amount to give themselves additional protection. Still, the losses related to your injuries may exceed the coverage amount. You will only be able to recover the policy limit from the insurance company.

In some cases, an insurance company denies a claim for legitimate, acceptable reasons; more often, an adjuster will contest your claim based upon other factors. If you do not know the law or how to address a denial, you put your right to compensation at risk. For more information on claims in car accident cases, please contact attorney Michael A. Freedman to schedule a consultation at our convenient Baltimore County, MD location.

See Related Blog Posts: