Even those who have never been in a car accident know that the purpose of auto insurance requirements is to protect against losses due to injuries and property damage. Every US state has implemented regulations on insurance, including the Maryland Department of Transportation (MD DOT). Motorists must carry a minimum of $30,000 for injuries to victims, $60,000 when there are 2 or more victims, and $15,000 in property damage. Another point you might know about car accidents and insurance is the effects on a policyholder who causes a collision. Often, premiums increase, deductibles increase, and an insurer may even drop someone considered a high-risk driver.

With this in mind, you may encounter a problematic scenario if you were involved in a crash: The other driver wants to pay you directly and avoid insurance. You probably have concerns about this option, and they are justified. It is important to follow the established legal process, which does mean bringing in the insurer. A Baltimore County auto accident attorney will go through the proper steps to pursue your remedies, but some tips may be helpful.

Tips if the Other Motorist Wants to Skip Auto Insurance

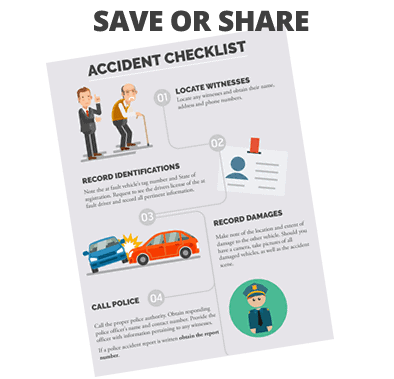

A useful pointer for any traffic crash is to stay calm and be polite, and this should be your approach when a driver wants to avoid insurance as well. When the subject of skipping the insurer comes up, a few additional recommendations include:

- Firmly reply that no, you cannot keep the other motorist’s insurance company out of the picture.

- If you did not already, call 911 to get first responders on the way. Police will conduct a brief investigation and interview drivers. In the presence of officers, request the other driver’s insurance information.

- While waiting for first responders, make sure to do your part on what the law requires. Provide your contact information and insurance details.

- Do not engage the driver if your request for insurance information is refused and they are still trying to convince you to take cash directly. There are ways to get the details you need and pursue the proper option of filing an insurance claim.

Why When You Avoid Insurance It Could Harm Your Rights

It might seem tempting to take the cash when the at-fault driver offers what seems to be a reasonable amount. The risk is that you do not know what amount is appropriate to compensate you, since you have no idea of the full extent of your losses. You might require significant medical treatment for your injuries, on an emergency basis and continuing possibly several weeks or months until you heal. Your injuries could be severe enough that you miss work, and they have a significant impact on your quality of life. There are too many unknowns to keep insurance out of the equation.

Rely on a Maryland Car Accident Lawyer to Protect Your Rights

To learn more about the proper channels after an auto crash, please contact attorney Michael A. Freedman. You can call 410.363.6848 or go online to schedule a free consultation at our offices in Owings Mills or Glen Burnie.